Beware of scams! UCU will never call and ask for sensitive information. If you're ever unsure who you're speaking with, hang up immediately and call us at 800.UCU.4510.

Smart banking with a soul

Looking for a digital credit union with a human touch? University Credit Union (UCU) offers a tech-forward banking experience with no hidden fees and reliable human support.

Smart Checking with no risk, high reward

Earn up to 3.00% APY*

Earn more with our Smart Checking account, offering up to 3.00% APY.

No overdraft fees, no monthly fees, and no minimum balance requirement

And if you need it, our Overdraft Line of Credit offers pre-approval up to $500 with an 18.00% APY fixed rate (minimum payment $25 or 5.00%).1

No in-network ATM fees

Simple, smart conveninence for you.

Get paid early with direct deposit

Say goodbye to paper checks and hello to instant access to your money. Direct deposit is a quick and hassle-free way to get paid without lifting a finger.2

Bank how you want, whenever you want

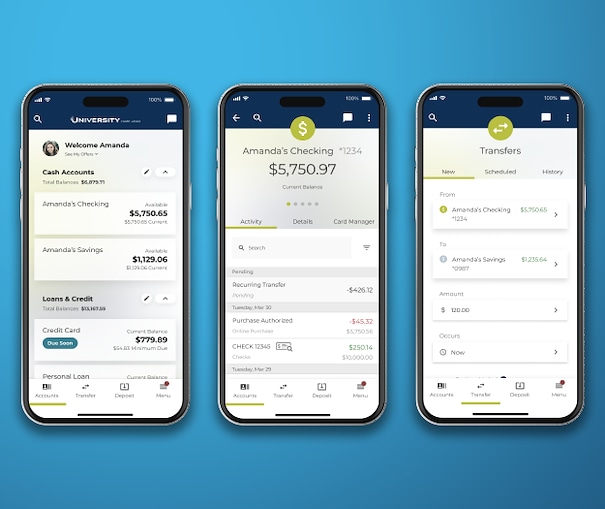

Whether you're paying bills at midnight or setting savings goals on your lunch break, UCU makes it simple. With our top-rated mobile app and smart digital tools, you get total control—with a real support team when you need one.

Bank smarter, not harder with the UCU mobile app

Fund transfers

Transfer funds instantly between your UCU accounts

Alerts

Set customized alerts and receive SMS notifications

Digital payments

Manage your loan payments through your digital banking portal

Mobile check deposit

Deposit checks in a snap with your phone

Real people. Certified guidance.

UCU is the only credit union where nearly every team member is a Certified Credit Union Financial Counselor (CCUFC). That means whenever you bank with us, be it online, in person, or on campus, you’re getting real support from someone trained to help you reach your financial goals.

The loans you need and the convenience you want

UCU offers a full suite of lending products to support you

From new and used auto loans to personal loans, HELOCs, mortgages, and more – all loans are available via an easy and secure online application process.

Credit cards designed to fit your lifestyle

Whether you're looking for a credit card that earnsrewards and cash back, or one that helps you build or rebuild your credit—UCU has the perfect option for you.

We have the best rates in the nation, guaranteed

Enjoy peace of mind and extra savings with UCU's Best Rates in the Nation Guarantee3—your assurance that you're getting a competitive, wallet-friendly rate.

Upgraded in-person experiences for the digital age

Visit us in-person or connect through a virtual 1:1 session with a certified expert and we’ll support your financial journey at your convenience. Our Shared Branch Network covers 5,600+ locations and nearly 30,000 ATMs, giving you local access to traditional banking services when you need it.

*APY = Annual Percentage Yield. To earn 3.00% APY, member must have a qualifying Smart Checking Account, opened August 1, 2024 and after. Based on a combined rate of 2.96%. All accounts must be in good standing with no delinquency or bankruptcy pending. Qualifying Smart Checking Accounts will earn 3.00% APY in dividends on balances up to $25,000. Balances above $25,000 will be paid at the regular checking rate.

Qualifying Smart Checking Accounts are defined as being enrolled in eStatements and having a direct deposit to the Smart Checking Account of at least $1,000 aggregated monthly. If the requirements are not met, then no dividend is earned. Secondary Smart Checking Accounts not eligible to earn APY. Dividends are calculated by the daily balance method, which applies a daily periodic rate to the balance in the account at the end of each day. Dividends are disbursed monthly into the active Smart Checking Account. APY is accurate as of the last dividend declaration date. Fees could reduce the earnings on the account. Rate subject to change after account opening and may vary based on qualifications met at month end. Not valid with any other offers. No minimum balance is required. To establish a UCU Membership, you must deposit at least $5 to a Regular (Share) Savings Account. A $50 minimum deposit is required to open a Smart Checking Account. All accounts are subject to approval. For other details regarding this account, you can reference your account disclosures, which detail all other terms and conditions.

1This needs some sort of disclosure or needs to be less specific in detail.

2Early access to direct deposit funds is dependent on the timing of the submission of the payment file from the payer. Generally, these funds are available on the day the payment file is received, which may be between two and six days earlier than the scheduled payment date.

3UCU guarantees that our lowest loan rate for cars, credit cards, consumer loans, and HELOCs are in the top 5% nationwide as measured in a monthly rate survey by Rate Watch, a part of S&P Global. Rates are subject to approval and based on an evaluation of credit history and other factors specific to your loan (such as loan term, credit score, loan amount, loan-to-value, and length of credit) and may be higher than the lowest rates advertised. Rates are subject to change at any time.